Filter by

SubjectRequired

LanguageRequired

The language used throughout the course, in both instruction and assessments.

Learning ProductRequired

LevelRequired

DurationRequired

SkillsRequired

SubtitlesRequired

EducatorRequired

Results for "market liquidity"

Status: Free Trial

Status: Free TrialCorporate Finance Institute

Skills you'll gain: Capital Markets, Financial Market, Investment Banking, Securities Trading, Investments, Market Liquidity, Private Equity, Sales, Financial Industry Regulatory Authorities, Business Acumen, Equities, Asset Management

Status: Preview

Status: PreviewIE Business School

Skills you'll gain: Financial Analysis, Financial Statement Analysis, Working Capital, Financial Statements, Cash Management, Cash Flows, Business Metrics, Financial Acumen, Business Acumen, Business, Accounting, Financial Accounting, Finance

Status: Preview

Status: PreviewUniversity of Pennsylvania

Skills you'll gain: Market Dynamics, Economics, Socioeconomics, Supply And Demand, Market Analysis, Business Economics, Public Policies, Policty Analysis, Research, and Development

Status: Preview

Status: PreviewThe Hong Kong University of Science and Technology

Skills you'll gain: Market Liquidity, Analysis, Financial Policy, Economics, International Finance, Financial Market, Financial Regulation, Market Dynamics, Supply And Demand, Forecasting

Status: Free Trial

Status: Free TrialDuke University

Skills you'll gain: Blockchain, FinTech, Interoperability, Payment Systems, Financial Inclusion, Financial Systems, Cryptography, Digital Assets, Financial Regulation, Banking, Encryption, Computer Security, Governance

Status: Free Trial

Status: Free TrialUniversity of Michigan

Skills you'll gain: Market Data, Finance, General Finance, Corporate Finance, Financial Analysis, Financial Market, Investments, Financial Data, Equities, Investment Management, Business Mathematics, Cash Flows

Status: Preview

Status: PreviewDuke University

Skills you'll gain: Oil and Gas, Market Dynamics, Energy and Utilities, Transportation Operations, Operations, Production Process, Market Trend, Cost Estimation, Market Analysis, Natural Resource Management

Status: Free Trial

Status: Free TrialUniversity of Geneva

Skills you'll gain: Financial Market, Capital Markets, Portfolio Management, Investments, Market Dynamics, Finance, Equities, Economics, Banking, Asset Management, Risk Management, Financial Analysis

Status: Free Trial

Status: Free TrialIllinois Tech

Skills you'll gain: Market Dynamics, Supply And Demand, Game Theory, Economics, Market Trend, Business Economics, Market Analysis, Consumer Behaviour, Operating Cost, Business Strategy, Competitive Analysis, Cost Management, Business Strategies, Strategic Decision-Making, Decision Making

Status: Preview

Status: PreviewSkills you'll gain: Derivatives, Financial Market, Risk Modeling, Mathematical Modeling, Financial Modeling, Credit Risk, Risk Management, Portfolio Management, Probability, Differential Equations, Applied Mathematics, Probability Distribution, Calculus

Status: Free Trial

Status: Free TrialNew York Institute of Finance

Skills you'll gain: Credit Risk, Risk Mitigation, Risk Management, Derivatives, Risk Analysis, Financial Analysis, Financial Market, Financial Statement Analysis, Portfolio Management, Market Trend, Cash Flows, Balance Sheet

Status: Preview

Status: PreviewIE Business School

Skills you'll gain: Market Research, Business Research, Customer Insights, Data-Driven Decision-Making, Quantitative Research, Market Analysis, Business Intelligence, Competitive Intelligence, Market Opportunities, Marketing, Data Collection

In summary, here are 10 of our most popular market liquidity courses

- Introduction to Capital Markets: Corporate Finance Institute

- Liquidity and Solvency in Financial Accounting: IE Business School

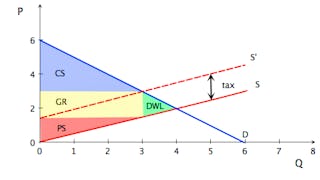

- Microeconomics: When Markets Fail: University of Pennsylvania

- Monetary Policy in the Asia Pacific: The Hong Kong University of Science and Technology

- Decentralized Finance (DeFi) Infrastructure: Duke University

- Stocks and Bonds: University of Michigan

- Oil & Gas Industry Operations and Markets : Duke University

- Understanding Financial Markets: University of Geneva

- Managerial Economics: Buyer and Seller Behavior: Illinois Tech

- Pricing Options with Mathematical Models: Caltech